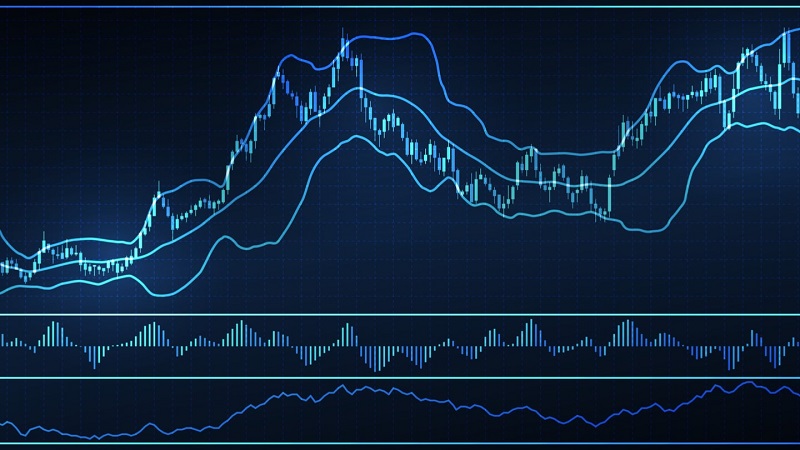

There are many tools in the market to analyze CFD chart effectively. Beginners may be confused by various indicators of the chart when they look at their device screens. But they should understand that they have to master on those indicators to get the real picture of the trends and to analyze the conditions of the market. The basic one can be analyzed to get the crucial information and set the tactics based on swing highs or lows. The movement analysis is an essential practice, which helps to find out the pitfalls in the existing platform based on tools and indicators provided by the graph.

What is CFD Trend?

CFD chart defines the tendency or pricing behavior that is related to price decrease or increase based on time-frame and currency pair. Primarily there are two types of trends in the trading platform, and those are Bullish and Bearish trend.

Common trends in CFD market

Bullish Movement

The bullish movement indicates the upward movement or overall rise in the actual price, and in this direction, we find the upper high or the upper low always on the rise in this situation. The price bounces to a bullish direction, and the bullish trend line works as the support level here. No matter what the cause if we find trend moving upward strongly then undoubtedly that is a bullish trend. Experts recognize the bullish trend based on the spikes in trading volume, increasing market share and focusing on higher highs or higher lows. To understand this important stages of the trend, you need a demo account. Being a rookie trader in Singapore, feel free to get it from here. By using the demo paltfrom at Saxo, you can easily know the important factors of trading.

Bearish Movement

The bearish direction is completely opposite to bullish direction and shows the downward movement of the pricing of specific currency in the foreign currency exchange business. This indicates the overall fall based on broad market indices and the lower low or lower high is always in a downward movement in this situation. The bear market provides a great opportunity for the investors to buy currencies at a low price. Even though there is a possible risk of the downward movement, some time for the maintenance of the long time-frame, the traders become able to generate profit from here.

Forex Trend Line

There are different indicators, and lines are the most effective ways to analyze the current market condition. A trend line indicates the diagonal line on the chart, which closely connects the bottoms and the tops on the FX graph. Based on the line, we get the support or resistance level with price action.

Trend Following system

In a chart, there are two types of moves which are closely related to the trend. They are impulses and corrections. The trend impulse helps to predict the financial movements of the price. In this type of movement, the price takes a higher swing based on a shorter time frame.

On the other hand, trend corrections indicate the downward movement, and it is not so attractive to the investors. This direction is smaller, but it stays longer. In FX trading, corrections come right after the impulse and then send it back to its previous movement.

Trading Volumes

Trading volumes are very helpful because in many cases it is found that currency pair in the platform starts trending when volumes increase. In such a way, we find that impulse direction moves upper during trading volumes. Using volumes can be useful to find out the emerging trends because when volumes are high, we find a lot of action in the market.

Analysis of the movement is really important to make the best decision and to visualize the platform. It helps to predict the next movement of the Forex industry, the upcoming swing, and traders can update their strategies based on the direction.